quicken tax planner problem

Purchase entitles you to Quicken for the term of your membership depending upon length of membership purchased starting at purchase. Since your taxes are based on a years worth of financial information the Tax Planner makes an educated estimate called a projection of the final year-end total of each tax.

Quicken Us Windows Releases Its Third Update This Month To Fix Its Chase Accounts Problem R Quicken

Keep in mind that Quickens Tax Planner is not intended as a tax-calculation tool.

. I just started using Quicken this year and overall like it but have found the Tax Planner to be unreliable. You can update this information as you work through the Tax Planner wizard. Therefore you must use three elements to create your retirement income.

Updated the W4 tax rates and mileage rates in the Tax Planner. Lets take a look at the problem review some common expenses you need to deduct and consider ways to save money on taxes this year. Make your tax prep easier this year with.

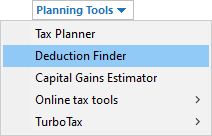

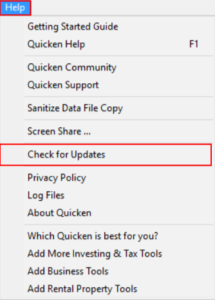

Choose Tax Tools Tax. If you experience this issue please follow the instructions here to. Click the Planning tab and then click the Tax Center button.

If you manually selected your filing status the program may reset it back to the default filing status. I am on R39232713923. Browse to the correct file and select it.

Click Show Tax Planner. On the Tax Center tab it is displaying an incorrect. Viewing the details of a Tax Planner field tells you not only where the data came from but also what type of data it isin other words whether its Quicken data such as a.

Full payment is charged to your card. When tracking business income and. Instead the purpose of the Planner is to give you a snapshot of your tax situation throughout.

Some users are reporting duplicate transactions with Chase. If youre able to open Quicken but youre not able to get. If you want to reset your user-entered data back to projections based on your Quicken data click Reset in the Tax Planner toolbar and then click Reset to Quicken Default Values.

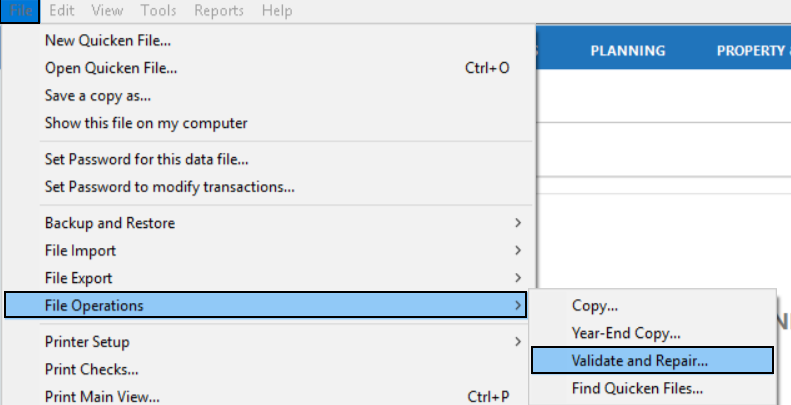

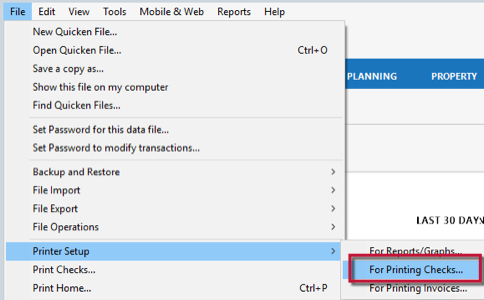

Close Quicken and open the now super-validated file. In Quicken click on File Open. Quicken will prompt you to convert the file when you.

Official Quicken Support - Phone Chat or Community. Check the tax information. This morning May 4 I opened Quicken saw that the Tax Planner problem was present and I immediately ran Super-Validate.

Any Tax Planner data fields for which no Quicken data is available are. Run super-validate from the menu by navigating to the file in the super-validate window. First ensure you have converted the correct data file.

Select the account from the Account List click Edit and then in the Account Details dialog click Tax Schedule Info.

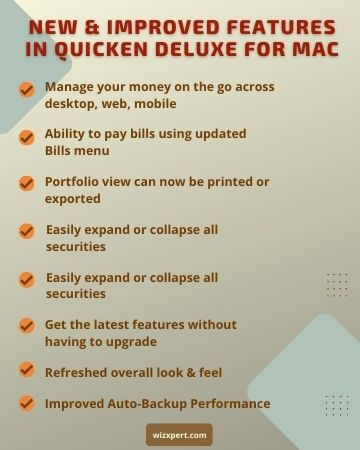

2022 Quicken Deluxe For Mac New Features Plans Pricing

Tips For Fixing Quicken Mistakes Quickly Cropwatch University Of Nebraska Lincoln

Estimated Tax Math In Planner Seems Incorrect Quicken

How To Make Tax Time Less Taxing With Quicken

Quicken Reviews And Pricing 2022

Personal Capital Vs Quicken Which Is Better Product

:max_bytes(150000):strip_icc()/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

How Rocket Mortgage Formerly Quicken Loans Works

Projected Tax Report Not Working Properly Quicken

Quicken One Step Update Not Downloading Bank Transactions

Quicken Vs Quickbooks Which Is Best For Small Business In 2022

Quicken 2019 For Mac Review Robert Breen

Set Up Printer Write Print Checks In Quicken For Window

Quicken Home Business Reviews 2022 Details Pricing Features G2

Beware Quicken Technical Customer Support Scams

Mint Vs Quicken Which Is Best For You In 2022 Personal Capital

Projected Tax Report Not Working Properly Quicken